Bf - SMIVsInsurance of Bank-financed Short-term Export Supplier Credit Covering Default Risk

Short description of insurance product and contacts

Case Study:

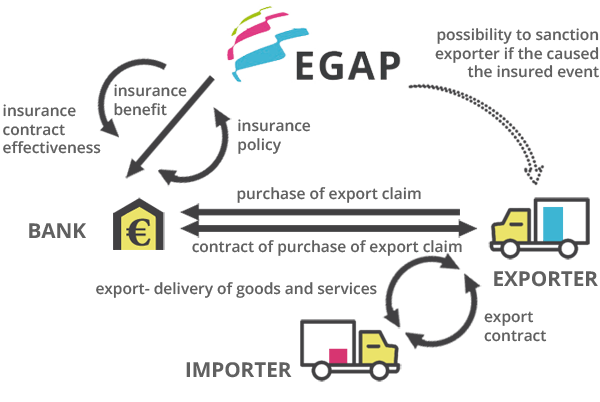

Sole trader Jan Kladívko comes home from an exhibition in Azerbaijan with the success of having found a new customer wishing to purchase nails for 10 million crowns, provided that there is a six-month payment window for goods supplied. While this is a huge triumph for Mr Kladívko, it comes with risks attached. What if the new customer doesn’t pay for the nails? For Czech sole traders, a ten-million-crown default could put them out of business. What’s more, Mr Kladívko can’t wait half a year for his money, because these are funds he needs for further production. He enters into an export contract with the importer and contacts his bank, which runs a solvency test at EGAP. The bank then concludes an insurance contract with EGAP and a factoring contract on the purchase of an export account receivable (invoice) with Mr Kladívko. Mr Kladívko exports the goods and sells his account receivable to the bank, for which he receives immediate payment. As far as Mr Kladívko is concerned, that is the end of the matter. Any default by the Azerbaijani importer is handled by EGAP and the bank.

Product description:

The export supplier's credit financed by the bank is the credit provided by the exporter to the importer (foreign entity) in the form of deferral of payment for the delivered goods or services (export claim), bought from the exporter subsequently by the bank without possibility of retroactive sanction.

The maturity of short tail export supplier's credit (export claim) is shorter than 2 years. The insured entity is bank against the risk that the importer does not pay properly the whole owing sum, i.e. the price for the delivered goods and services (export claim) in the due date. The insurance policy shall be signed also by the exporter acknowledging all his obligations following from the insurance policy, especially the obligation to perform properly the export contract.

Ing. Jan Dubec, Director of Acquisition and Supplier Credit Insurance Department

+420 222 842 328

dubec@egap.cz

Basic Conditions of Bf - SMEs Insurance

- The insured credit/receivable is payable within 2 years

- The maximum amount of the credit/receivable is CZK 40,000,000

- The exporter (unless a foreign company) is an exporter meeting the definition set out in Act No. 58/1995

- The exporter meets the criteria for SMEs in accordance with Annex I to Commission Regulation (EU) No 651/2014 of 17 June 2014 declaring certain categories of aid compatible with the internal market in accordance with Articles 107 and 108 of the Treaty

- The exporter is not the subject of criminal prosecution, and is not a liable party in the enforcement of a ruling, in enforcement proceedings or in insolvency proceedings

- The debtor (importer) and the exporter are not interlinked economically or financially

- The export, the country of destination of the export, and the entities involved are not subject to international sanctions

- The share of the value of supplies originating in the Czech Republic in the export value – rules you can find here,

- The insurance of credit or an account receivable linked to agricultural products listed in Annex 1 to the Agreement on Agriculture, constituting part of the Agreement Establishing the World Trade Organisation (WTO), the maturity of which must not be more than 18 months (from the starting point of credit to the contractual final maturity date)