IInsurance of Investment in Foreign Countries

Brief description of the insurance product and contacts

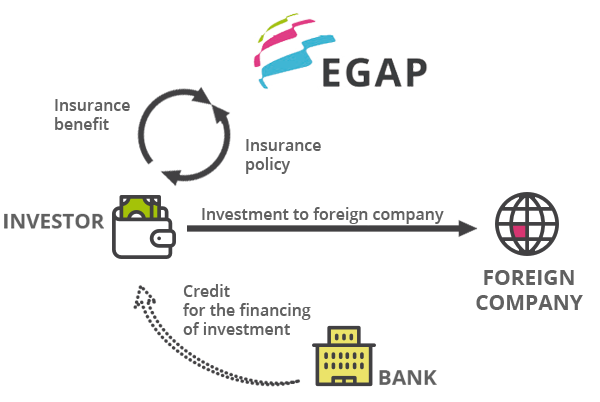

An investment in a foreign country is any property value remitted to the foreign subsidiary in relation to entrepreneurial activities of the Czech investor.

For example, it may be Greenfield construction of a new production capacity as well as a purchase of an established production, acquisition of an interest in a foreign company, or additional capital for supporting business expansion of the foreign company. The investment has to represent a long-term commitment of the investor for the period of at least 3 years. Any Czech legal person may be an investor. In case of the investment with potential environmental impacts, EGAP reserves the right to request from the investor to submit an expert opinion. Insurance covers the investor against the risk of prevention of the transfer of returns on the investment, expropriation or politically motivated violent damage.

An insurance loss is a full or partial loss of value of the investment, full or partial non-execution of transfer of dividends, returns, profits from the insured investment after all taxes and fees, not even in the waiting period, for political or other non-commercial reasons which are impossibility of conversion of returns, expropriation, violent political acts and breach of contractual obligations by the host country.

The amount of the insurance premium depends primarily on the assessment of risk level of the host country and whether the Czech Republic has concluded with the host country an international agreement on protection of investments, and on the amount of the self-retention. The negotiated amount of the insurance premium already includes possible increase or decrease of the insurance risk and is unchangeable during the whole duration of insurance.

The preliminary premium calculation is available through interactive calculator.

+420 222 842 354

jankumi@egap.cz

Ing. Michal Pravda, Deputy Director

+420 222 842 348

pravda@egap.cz

Basic terms and conditions of insurance

- the investor is a legal entity meeting the requirement of registered office and property interest under act No. 58/1995 Coll.

- the investor has existed and executed the activity being the subject of investment for no less than 2 years before submitting the application for insurance investment abroad or its activity follows up on the activity of its legal predecessor, carried out for no less than 2 years before submitting the application for insurance of investment abroad (this does not concern a foreign company if newly established by the investor)

- company which is subject of investment is a legal entity based outside the Czech Republic:

- which is being founded or acquired by the investor or

- in which the investor is to increase its share or

- in which the investor spends financial or other values expressed in monetary terms or property rights in order to expand its business,

all of the above under the condition that the legal entity is controlled by a legal entity based in the Czech Republic through a direct or indirect share of more than 50 % in its registered capital or controlled by the absolute majority of rights of vote associated with share in the registered capital of the company or is entitled to appoint the majority of board members, members of supervisory board or other similar top authority of the company. - trouble-free credit history1 of entities2 participating in investment

- the investment is spent by the investor and has the form stipulated in Act No. 58/1995 Coll.

- the investment must be spent by the investor for a period of at least 3 years

- the investment is established, or spent, as the case may be, in accordance with the law of the host country, and the investor has obtained necessary permissions from the host country

- it is not investment in:

- manufacture of weapons,

- gambling or highly speculative projects,

- production of narcotic and psychotropic substances.

- environmental and social impact assessment of the investment in the target country and non-applying of international sanctions towards entities involved in the investment